The devices or property remaining financed serves as collateral. In some cases, borrowers may be questioned to offer further collateral.

Your CDC and bank lender can have distinct standards that you simply’ll require to fulfill at the same time. These criteria could vary, but lenders will typically choose to see good credit and robust revenue.

Wishes to meet substantial contracts or assignments and/or borrow versus accounts receivable or inventory

To assist you to budget with self esteem, you will see your month-to-month costs along with the payment owing dates for your loan expression prior to deciding to acquire out a loan.

To make sure that we can easily assess your eligibility for a Business Line of Credit history, you need to supply some basic facts, like:

Semrush is actually a trusted and extensive Instrument that provides insights about on the internet visibility and effectiveness. The BestMoney Total Score will include the brand's standing from Semrush. The manufacturer status is predicated on Semrush's Assessment of clickstream details, which includes consumer behavior, research designs, and engagement, to properly evaluate Just about every manufacturer's prominence, credibility, and trustworthiness.

The 504 loan process would require intensive documentation, but particulars might vary according to your lender. In general, you’ll be requested to deliver:

Invoice factoring: This can be a sort of progress on your fantastic invoices, exactly where the lender efficiently purchases your business’s accounts receivable.

Borrowers needn't apply for this help. SBA provides this assistance quickly as presented under:

Making use of for an SBA loan usually will involve a lengthier software course of action than for an everyday business loan. The following is a summary of factor lenders may perhaps just take into account:

We purpose to supply worthwhile written content and beneficial comparison capabilities to our guests via our cost-free on the internet source. It is important to note that we receive advertising and marketing payment from businesses featured on our web-site, which influences the positioning and get by which makes (and/or their solutions) are shown, in addition to the assigned score. Be sure to remember that the inclusion of corporation listings on this site doesn't imply endorsement.

SBA loans are created to ensure it is a lot easier for compact businesses to obtain funding. If the business has fatigued all other funding solutions, you may be able to get an SBA loan.

In relation to credit score restrictions and conditions, business charge card acceptance is generally according to your own credit score score. A line of credit rating, However, offers far more adaptability on approval amounts, normally has decreased curiosity charges, and can be employed to tug hard cash into your running account to include operational expenses or tackle seasonal revenue shortages.

The extent of help may differ depending on when the loan was authorised and can sba 504 loan commence on or just after February one, 2021. Please Make contact with your lender for questions on The supply of this aid to your SBA loan.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Hailie Jade Scott Mathers Then & Now!

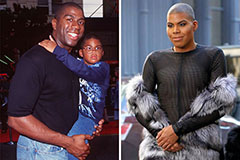

Hailie Jade Scott Mathers Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!